Financial literacy for kids is one of the most powerful life skills parents can teach. In today’s world, where digital spending and online shopping are part of daily life, understanding money early helps children develop responsibility, confidence, and independence.

At SELF4KIDS Learning Center in Irvine, we believe that financial literacy for kids should start with fun, relatable lessons that grow with them — turning everyday experiences into meaningful learning opportunities. From identifying needs versus wants to saving for big goals, kids can learn to make smart decisions that will shape their financial future.

Contents

- 1 What is Financial Literacy for Kids?

- 2 What is the 50/30/20 Budget Rule for Kids?

- 3 What are the 5 Principles of Financial Literacy?

- 4 What is the 70-10-10-10 Rule for Money?

- 5 What are the 5 C’s of Financial Literacy?

- 6 What is the Fastest Way to Save Money for a Kid?

- 7 How Kids Will Grow Their Financial Literacy Step by Step

- 8 List of Top 10 Important Things Kids Should Know About Money

- 9 Why is financial literacy important for young ages?

- 10 FAQ: Financial Literacy for Kids

- 11 Conclusion

What is Financial Literacy for Kids?

Financial literacy for kids means understanding how money works — earning, saving, spending, sharing, and investing wisely. It’s not about teaching complex economics, but about helping children recognize value, make choices, and plan ahead.

When children understand the basics of budgeting and saving, they develop habits that last a lifetime. At SELF4KIDS, our financial literacy programs use storytelling, interactive games, and real-world simulations to help kids practice:

- Setting savings goals

- Creating simple budgets (spend, save, share)

- Understanding work and income

- Making informed spending choices

By introducing these lessons early, you’re giving your child the foundation for lifelong financial success.

What is the 50/30/20 Budget Rule for Kids?

The 50/30/20 budget rule helps children learn how to divide their allowance or earnings responsibly:

- 50% for needs: essentials like school supplies or small daily items.

- 30% for wants: toys, games, or special treats.

- 20% for savings: long-term goals like a bike or educational trip.

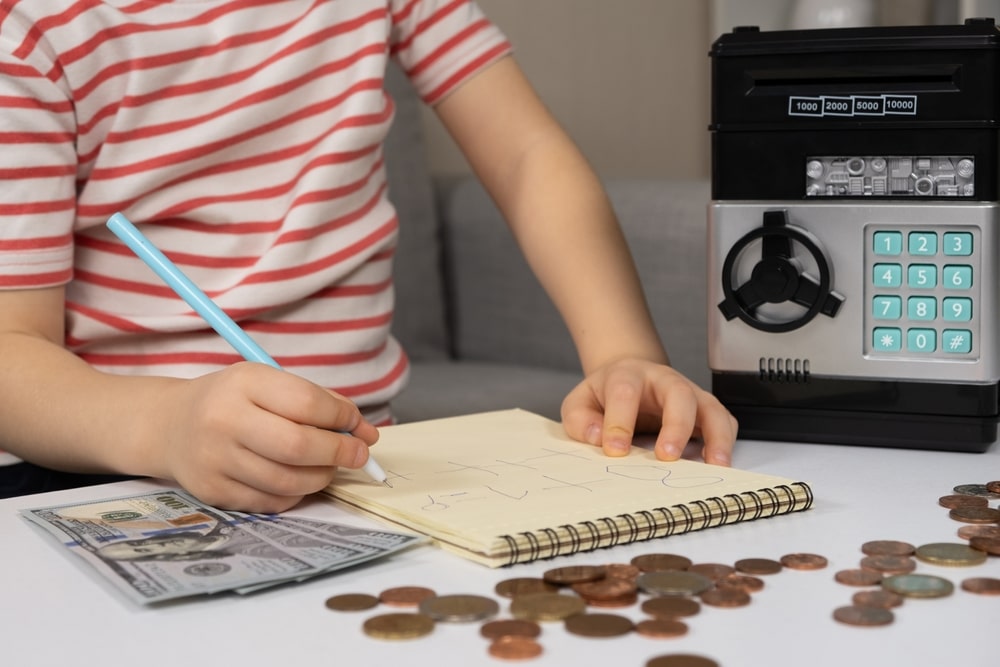

This rule helps kids visually understand how to balance spending, saving, and enjoyment — a crucial step in developing healthy financial habits. Parents in Irvine can apply this method by using jars, envelopes, or digital piggy banks labeled with each category to make it engaging and visual.

What are the 5 Principles of Financial Literacy?

At SELF4KIDS, we simplify the five principles of financial literacy so kids can remember and apply them easily:

- Earn Wisely: Understand where money comes from — chores, part-time work, or creative projects.

- Spend Thoughtfully: Distinguish between needs and wants before buying.

- Save Consistently: Set short- and long-term goals, no matter how small.

- Invest Early: Learn the concept of growth — even saving in a jar teaches compounding patience.

- Give Generously: Sharing teaches empathy and balance between self and community.

These principles help children connect money with values — responsibility, generosity, and awareness.

What is the 70-10-10-10 Rule for Money?

The 70-10-10-10 rule is a more advanced version of money management for kids as they grow older. It divides income or allowance into:

- 70% for spending: daily needs and fun.

- 10% for saving: future goals or emergencies.

- 10% for investing: to learn growth over time.

- 10% for giving: to develop compassion and social responsibility.

Teaching this rule helps children understand that money isn’t just for consumption — it’s also a tool for growth and kindness.

What are the 5 C’s of Financial Literacy?

Financial literacy for kids also includes the 5 C’s, which teach decision-making and personal finance evaluation:

- Character: Building trust by handling money responsibly.

- Capacity: Understanding how much they can afford or save.

- Capital: Recognizing savings as their “financial cushion.”

- Collateral: Learning how valuable items can support goals.

- Conditions: Adapting spending habits based on real-life situations.

These concepts can be simplified for younger learners through games and visual examples at SELF4KIDS — for example, comparing saving tokens or using pretend stores to illustrate capacity and character.

What is the Fastest Way to Save Money for a Kid?

The fastest way for kids to save money is through consistency and motivation. Small actions lead to big results. Parents can help by:

- Setting clear goals with visual trackers.

- Offering a matching contribution (like a “parent bonus” for saving).

- Using a physical or digital piggy bank for transparency.

- Encouraging kids to sell crafts, recycle cans, or take on small projects.

At SELF4KIDS in Irvine, children learn to connect effort with reward — understanding that saving is not about restriction, but empowerment.

How Kids Will Grow Their Financial Literacy Step by Step

Financial literacy for kids develops gradually. Here’s the recommended growth roadmap:

Step 1: Understanding Value (Ages 4–7)

Introduce coins, bills, and their meanings. Use pretend stores and simple exchanges.

Step 2: Making Choices (Ages 7–9)

Start discussing needs versus wants and introduce basic budgeting games.

Step 3: Planning Goals (Ages 9–11)

Encourage kids to set small saving targets, like earning money for a book or toy.

Step 4: Managing Income (Ages 11–13)

Introduce weekly allowances or small tasks for payment, applying the 50/30/20 rule.

Step 5: Practicing Responsibility (Ages 13–15)

Teach them about debit cards, saving accounts, and early investing concepts.

Each step builds confidence, independence, and accountability — the true essence of financial literacy for kids.

List of Top 10 Important Things Kids Should Know About Money

- Money comes from effort, not magic.

- Saving a little regularly grows faster than saving a lot once.

- Needs come before wants.

- Every choice has a cost — that’s an opportunity cost.

- Giving helps others and brings joy.

- Comparing prices saves money.

- Credit is borrowed money — always repaid on time.

- Budgeting keeps goals clear and reachable.

- Investing grows money over time.

- Being patient is the secret to financial success.

These lessons help children see money as a skill, not stress — shaping their mindset for a balanced, confident adulthood.

Why is financial literacy important for young ages?

Financial literacy for kids is one of the most essential life skills a parent can nurture early on. When children understand how money works—how it’s earned, saved, spent, and shared—they begin to see the world through a lens of responsibility and independence.

Teaching these lessons from a young age empowers children to make thoughtful financial decisions as they grow. Instead of viewing money as something mysterious or stressful, they learn that it is simply a tool—one that can be used wisely to reach goals, help others, and create security.

Starting financial literacy for kids early also helps them form healthy money habits before negative patterns develop. Through practical lessons like saving part of their allowance, comparing prices, or setting short-term and long-term goals, children learn discipline and patience. These everyday experiences teach them to think ahead, evaluate their options, and understand consequences.

For example, deciding between buying a toy now or saving for something bigger later introduces them to delayed gratification—a cornerstone of financial success.

Beyond managing their own money, financial literacy for kids builds emotional intelligence. It encourages gratitude for what they have, empathy when giving to others, and confidence when making independent choices.

As they grow older, these early lessons evolve into real-world understanding—budgeting in college, managing credit, and planning for the future. Parents play a vital role in guiding these conversations and modeling smart financial behavior at home.

In the long run, teaching financial literacy to children is about much more than math or money—it’s about character, confidence, and freedom. By starting early, parents give their kids the foundation to make informed choices, avoid financial stress, and live empowered lives. It’s not just education; it’s preparation for a secure and successful future.

FAQ: Financial Literacy for Kids

1. Why is financial literacy important for kids?

Because it teaches responsibility, decision-making, and independence, essential life skills for future success.

2. What are the basics of financial literacy for kids?

Earning, saving, budgeting, spending wisely, and sharing are the foundation blocks every child should master.

3. When should parents start teaching kids about money?

Start early — as soon as children can count and understand the concept of exchange (usually around age four).

4. Where can kids learn financial literacy in Irvine?

SELF4KIDS Learning Center offers engaging, age-appropriate financial literacy programs that make learning about money fun and practical.

5. Who should teach kids about money?

Both parents and educators. Home examples paired with professional guidance create the strongest impact on long-term habits.

Conclusion

Financial literacy for kids is not a luxury — it’s a necessity for raising confident, capable young adults. By teaching the value of money early, parents in Irvine help their children build lifelong skills that go far beyond math.

At SELF4KIDS, our mission is to make financial learning fun, relatable, and empowering. Through interactive lessons, real-world examples, and family participation, we help kids transform simple savings into strong financial habits.

Start early. Stay consistent. Watch your child grow into a financially wise, independent thinker — ready to face the future with confidence.